By Lauren Means

My wife and I are animal lovers. We have had many pets in our lifetimes between the two of us including dogs, cats, fish and even mice. We currently have two sweet dogs — a beagle named Franklin and a bagel (basset-beagle) named Daisy. They are our children and we devote most of our time and energy to them.

From routine care like annual checkups, vaccinations, and flea and tick prevention to emergent care including X-rays and ultrasounds for injuries and suspicious bumps, we are no strangers to vet bills. We had discussed pet insurance at various times but as Franklin and Daisy were generally in good health, it never made the cut when we were budgeting expenses.

We began to question our decision to not insure our pets in 2018. This was the year we had to pay out for two ACL (knee) surgeries — Franklin in March and then Daisy in October. It was one of the most expensive years we have had in vet bills. Could pet insurance have lessened the financial hit? Should we consider getting pet insurance now?

There are several things to consider before purchasing pet insurance.

- What type of coverage are you getting?

If you do a simple Google search for pet insurance, the number of offerings can be overwhelming. There are many different options from many different companies. You can elect for an Accident and Illness Plan, which covers unexpected incidents like broken bones, being hit by a vehicle, ingestion of poisonous items, cancer or infection. Some have wellness benefits that cover preventative care like wellness exams, vaccinations and routine lab work. Some even have dental elections that will cover teeth cleanings.

- Are there limitations or exclusions?

Most plans do not cover anything they consider a pre-existing condition. This can include prior injuries or surgeries, history of cancer or other chronic health conditions, and possibly even allergies or skin conditions if the animal has been tested for allergies in the past.

There can also be exclusions for possible genetic conditions — even if they are not currently present — simply based on the animal’s breed. This can include some heart conditions, neurologic (brain) conditions, hearing loss, and some kidney diseases just to name a few.

Pet insurance usually has a waiting period which is a timeframe from when the policy is activated and when you can file your first claim. With one popular insurance company, Embrace, the policies have a 14-day waiting period for illnesses, a waiting period of 48 hours for accidents, and a six-month waiting period for orthopedic conditions.

- Get more than one quote.

Cost can vary widely between companies and can depend on the age and breed of your animal. There are also various types of deductibles, which is the amount you have to pay out of pocket before being reimbursed from the insurance plan. There are plans with a once per year deductible, where after you pay the deductible for the year, you are reimbursed for any other claims during the annual period. Some plans have per incident deductibles, which requires you to pay a deductible amount each incident before they will pay out.

There are also options on deductible amounts and reimbursement percentages. These are all things you must consider when selecting a plan.

In the end, pet insurance may not be for everyone. One of the most important things to keep in mind when deciding on pet insurance is that it is not an investment. You may or may not get out of it exactly what you put in moneywise. It is insurance just like health insurance, car insurance, home/rental insurance, etc. You are paying a small amount upfront in the hopes you never have to use it but knowing it is there in the unfortunate event you have to submit a claim. You are paying for peace of mind.

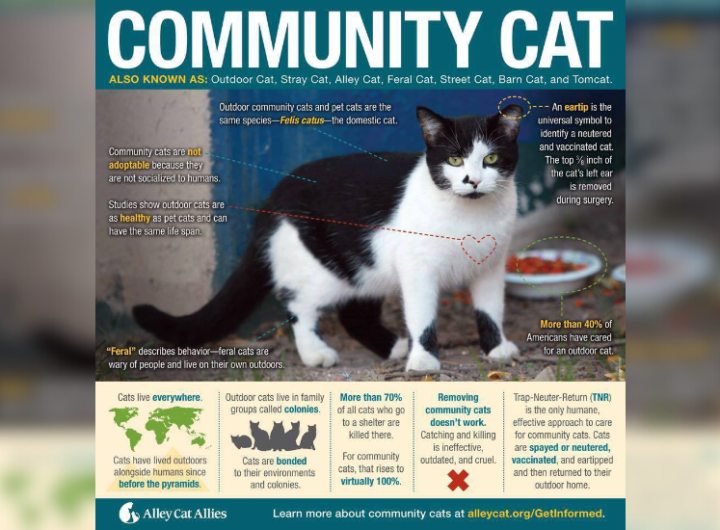

Local Clinics partnering with Alley Cat Allies for Global Cat Day, National Feral Cat Day

Local Clinics partnering with Alley Cat Allies for Global Cat Day, National Feral Cat Day  Pawster Nashville’s Fourth Birthday Celebration was a DRAG!

Pawster Nashville’s Fourth Birthday Celebration was a DRAG!  Every Dog Has its Day at Cheekwood’s Dogs and Dogwoods

Every Dog Has its Day at Cheekwood’s Dogs and Dogwoods  Crisis Foster Organization Pawster Nashville Offers “50 for 50” Gift Card Incentive

Crisis Foster Organization Pawster Nashville Offers “50 for 50” Gift Card Incentive  Building a Solid Foundation: Health, Wealth, and Legalities After Saying ‘I Do’

Building a Solid Foundation: Health, Wealth, and Legalities After Saying ‘I Do’  Protecting What Matters Most: Ryan Peacock Talks Estate Planning

Protecting What Matters Most: Ryan Peacock Talks Estate Planning